December 3rd, 2024

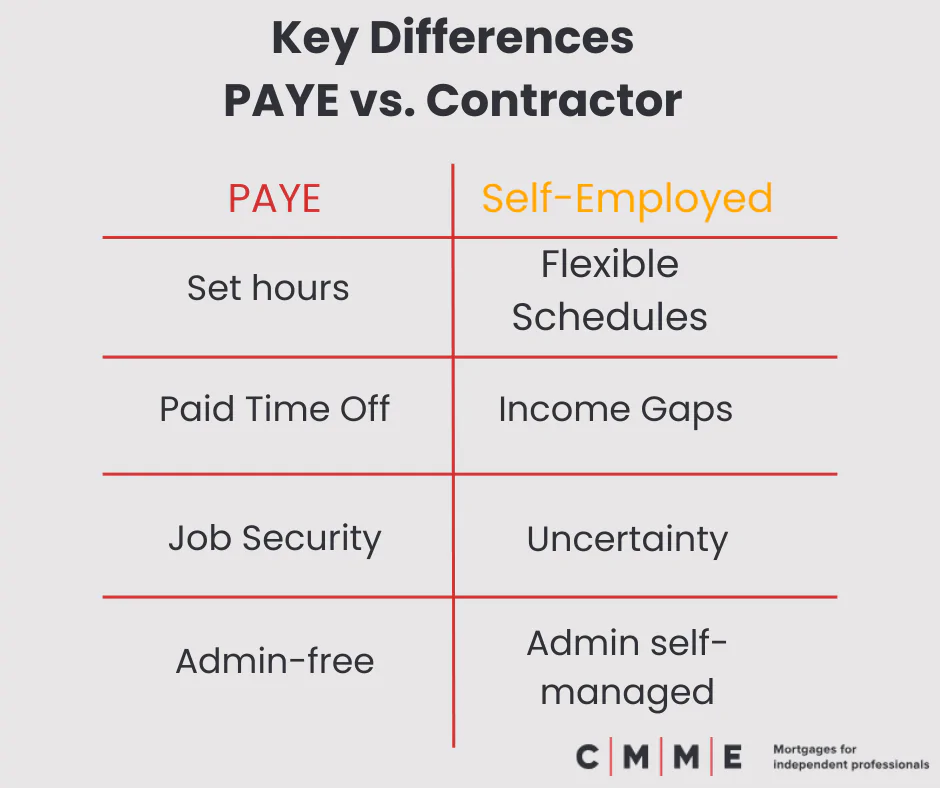

As a self-employed professional or contractor, your work-life balance looks vastly different from that of someone in a traditional PAYE (Pay As You Earn) role. Unlike regular employees, you don’t have the luxury of fixed hours, guaranteed paydays, or built-in benefits like paid holidays. Instead, you juggle freedom and flexibility with the demands of running your own business—client relationships, irregular income, and self-managed taxes all come into play.

For CMME clients, understanding these differences is key to building a sustainable work-life balance. Here’s how you can tailor your approach to thrive both professionally and personally.

The Key Differences

1. Set Work Hours and Stick to Them

While PAYE employees clock in and out, self-employed professionals often fall into the trap of working late into the night or over weekends to meet deadlines or take on more clients. While flexibility is a perk, a lack of structure can lead to burnout.

- Create a routine: Set working hours that align with your productivity peaks, but enforce a cut-off time to preserve personal time.

- Schedule downtime: Just as employees have evenings and weekends free, ensure you carve out regular time to relax, recharge, and spend with loved ones.

CMME’s mortgage specialists understand the unpredictability of contractor life and can help you secure financial stability, so you don’t feel pressured to overwork.

2. Plan Ahead for Time Off

Unlike employees, contractors don’t get paid leave or sick days. This makes planning time off a strategic necessity to avoid income gaps or missed opportunities.

- Budget for breaks: Save a portion of your income during busier periods to cover holidays or slower months.

- Set client expectations: Inform clients well in advance about your availability to avoid last-minute work demands during your downtime.

With CMME’s expertise, you can structure your finances to ensure you’re prepared for time off without impacting your income stability.

3. Manage Irregular Income

For PAYE workers, paychecks arrive like clockwork. Contractors, however, often deal with inconsistent payments and varying workloads. This financial uncertainty can make it harder to relax and enjoy your personal time.

- Set up a financial buffer: Aim to save at least three to six months’ worth of expenses to cover income gaps.

- Simplify invoicing: Use tools like Xero or QuickBooks to streamline client payments and keep track of what you’re owed.

- Work with experts: CMME can help you navigate irregular income to secure mortgages or financial products typically designed for PAYE workers.

Financial stability helps reduce stress and gives you confidence to focus on your personal life when needed.

4. Outsource Admin Tasks

Unlike PAYE employees who have HR teams and payroll systems managing their benefits and taxes, self-employed professionals handle all administrative tasks themselves. This extra workload can encroach on your personal time.

- Automate where possible: Use software to streamline invoicing, scheduling, and tax tracking.

- Delegate non-core tasks: Consider hiring a virtual assistant or outsourcing accounting to reduce your workload.

By focusing on what you do best—your core business—you’ll free up time to enjoy the perks of self-employment. CMME’s team can also help simplify complex financial decisions, from insurance to tax-efficient savings.

5. Set Client Boundaries

Employees often have clear job descriptions and working hours, while contractors may feel pressured to be “always on” to secure repeat business. This can lead to scope creep and constant availability.

- Define your terms: Use contracts to outline your working hours, response times, and scope of work. This ensures clients respect your boundaries.

- Say no when needed: Turning down low-value or poorly timed projects can protect your well-being and free up time for higher-priority tasks—or personal time.

With support from CMME, you can feel confident in building a business model that prioritizes quality over quantity, helping you achieve a healthier balance.

6. Reframe “Feast or Famine” Thinking

One of the biggest differences between PAYE and self-employment is the lack of guaranteed income. While employees enjoy a regular paycheck, contractors may experience periods of abundance followed by quiet months.

- Diversify income streams: Consider offering retainer agreements or additional services to smooth out cash flow.

- Plan for lean periods: Use busier times to save and invest, ensuring you can weather quieter periods without stress.

CMME specialises in helping contractors navigate these income fluctuations to achieve long-term financial security, making it easier to focus on work-life balance.

7. Prioritise Mental Health and Self-Care

PAYE workers often benefit from company-provided support systems, such as employee assistance programs or wellness initiatives. Contractors need to take the initiative to build their own support networks.

- Invest in your health: Schedule regular exercise, take breaks, and engage in hobbies to recharge.

- Seek professional advice: Whether it’s financial guidance from CMME or emotional support from a coach, getting help can make self-employment far less isolating.

8. Regularly Revisit Your Goals

Employees often follow career paths outlined by their employers, but as a contractor, you have the freedom to define success on your own terms. Regularly evaluating your goals helps ensure your work-life balance aligns with your long-term aspirations.

- Are you taking on projects that align with your values?

- Are you dedicating enough time to family, hobbies, or travel?

CMME’s team can help you structure your finances to support both your business and personal goals, ensuring you build the lifestyle you envisioned when choosing self-employment.

Work-Life Balance is Within Reach

The differences between self-employment and traditional employment require a tailored approach to work-life balance. While the challenges—such as irregular income and a lack of built-in benefits—are real, the solutions are within your control.

As a CMME client, you have access to financial expertise designed specifically for contractors and self-employed professionals. Whether that be getting the mortgage deal that’s right for you, protecting your income stream, or seeking tailored financial advice.

By setting boundaries, managing your workload, and leveraging expert support, you can enjoy both the flexibility of self-employment and the fulfillment of a well-balanced life.