March 8th, 2021

Today is International Women’s Day, it is a global day celebrating the social, economic, cultural and political achievements of women. Today we want to call attention to the women in the self-employed community independently, powerfully making waves in their industry and in home ownership.

From the International Women’s Day website, this year’s theme is Choose to Challenge:

“A challenged world is an alert world and from challenge comes change.

So let’s all choose to challenge.”

Every day self-employed women choose to challenge the conventional format for their working lives; they choose for themselves their dreams and aspirations, they choose balance and to be their own boss and they choose home ownership. Today we want to celebrate self-employed women, female contractors, women in all their forms Choosing to Challenge.

What’s In The Blog?

- Self-Employed Women & Female Property Ownership

- Meet Hannah, One of Our Mortgage Experts

- 5 Top Tips For Getting Your Mortgage

- Useful Resources

Self-Employed Women & Female Property Ownership

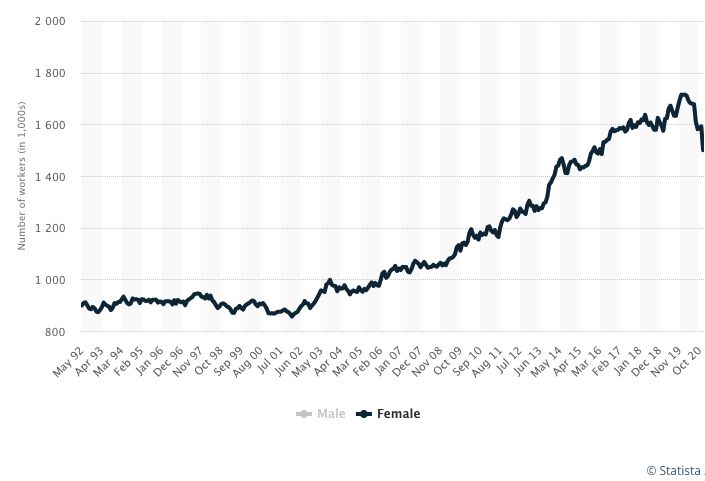

Women make up a whopping 1.5 million of the self-employed community and this number has only been growing since the 90s, each year more and more women choose to work differently and independently.

In recent research conducted by Recruit Venture Group, self-employed women are doing better than ever:

- 72% of women who have their own business are in their dream job

- 60% of women are now much happier for having their own business

This compares to only 9% of female employees who have found their dream job working for someone else, and 24% of female full-time employees who dream of starting their own business.

Home Ownership

According to Real Homes, on average as many women enquire about mortgages as men and in fact, in the 18 to 25 category, women actually enquire more – at 18% vs 15% of men in the same age bracket, though far fewer qualify for the mortgage. It seems, men’s mortgage affordability power is 15% higher than women’s. While men’s average salaries in the past decade have qualified 80% of them for a mortgage on a typical terraced house, while only 65% of women would qualify for the same type of property in the same time period.

What’re CMME Doing About It? Hear From Mike Coshott, CEO of CMME:

“CMME believes the way people choose to work should not limit their choices in life; Historically, this sector [self-employed] – which makes up some 15% of the UK’s workforce – has faced continued challenges when it comes to securing a mortgage”

“We hope to continue our work in changing the risk appetite and lending criteria for the self-employed in order that this invaluable sector of society gain access to the mortgages they deserve”

Meet Hannah, One of Our Mortgage Experts

Hannah’s one of our mortgage experts here at CMME, watch her video to find out how you can improve your credit conduct ahead of your mortgage plans this year.

5 Quick Tips For Women to Get Mortgage Ready This International Women’s Day

1.Check your credit report

Lenders have become increasingly risk-conscious and are continually on the lookout for reasons not to lend. A good deposit and a satisfactory income is often not enough to secure a mortgage.

That is why it is essential to keep your credit rating up to scratch, leaving the lender no reason to turn you down. It’s important to note that a poor credit score does not guarantee that you will not be approved for your mortgage application – in the same way, a good score does not guarantee approval – though a strong credit score is the first step towards approval.

Check out CMME’s free guide on credit rating.

1a. Improve your credit score

In light of step one, this step is applying the knowledge that is gained in being aware of your credit score and what sits on your credit report.

Here are some quick tips for improving your credit score:

- Register on the electoral roll

- Check for any errors and have them removed

- Pay off existing debt

- Don’t do lots of credit checks

- Pay your bills on time, don’t miss payments

Try an app like Credit Karma for keeping track and finding tips for improving your credit score.

2.Decide on your budget

In light of Coronavirus, many lenders have reduced the availability of high Loan-To-Value (LTV) mortgages meaning that you will often require a higher deposit than you may have previously, somewhere in the 10-15% range is more prevalent than a 5% in the current climate.

Lenders tend to favour individuals who have higher deposits, but this is true to anyone looking for a mortgage and not just contractors.

To access the most competitive rates you should be aiming to save anything between 10 and 25%. There are mortgage options out there for less than that, but they will be on a much higher rate.

We asked our experts everything you need to know about deposits, check it out here.

3.Get your paperwork sorted

You will need to provide minimal documentation to support your application. Ensure your CV is up to date as it will be used to prove your skills and experience.

You will also need to obtain a copy of your current contract as this will be used to demonstrate your earnings. Using both of these documents we can avoid any issues to do with affordability.

Our process is a simple as that. We won’t ask you for heaps of documents we might not need, we know the way you work, and we’ll make the process as easy as can be.

We asked our experts everything you need to know about documents, check it out here.

4.Investigate the market

Before you start your mortgage process, it’s a good idea to have a look at the market – investigate what type of mortgage might suit you and your needs, what area would suit you and the costs associated with your new mortgage and property.

Whether this is your first mortgage or your fifteenth, preparing in advance can help make sure your goals are realistic and achievable.

For an idea of what’s coming up this year for contractors, which might affect you and your mortgage plans, take a look at our recent article here.

5.Speak to a specialist

The truth is that most lenders have little understanding about the contracting market, and as a result, their standardised procedures do not accommodate contractors.

We have agreed bespoke underwriting agreements with a comprehensive range of lenders enabling us to secure mortgage funding based on a multiple of your contract rate alone.

Useful Resources

Happy International Women’s Day – here are some useful resources for getting your 2021 mortgage!

- The Contractor’s Guide To Help To Buy Mortgages | CMME

- Contractor Mortgage, Calculators and Tips for 2021 | CMME

Whether you want to talk specifics or are just after some general advice, CMME can help. Speak to us today on 01489 223 750 for a completely free, no-obligation mortgage consultation. Or click the button below.